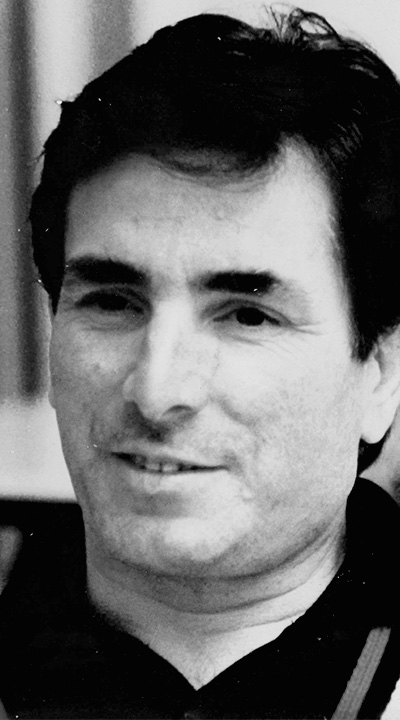

The untimely death of Dimitris Manios in 1995 at age 43 robbed Greek shipping of a handsome jet-setting young tycoon who had begun to attract comparisons with the prototype of the ‘golden Greek’ shipowner, Onassis.

Manios and his siblings grew up in the Athens suburb of Pangrati, where the family had owned a grocery shop since the early 1930s. However, the family fell on hard times before the children had finished schooling. Manios’ older brother Vassilios, 22 months senior to Dimitris, had set his sights on training to become a doctor, but instead he went to sea as an immediate way to earn money for the family.

Dimitris was initially determined to follow in Vassilios’ footsteps, going so far as to acquire a seaman’s booklet, but was deterred by his brother. Instead, he joined the police force, remaining a policeman for several years until his national service obligation was discharged.

He also began law school, where he made his first acquaintances from shipping families. In the summer he sold souvlaki by the roadside to help support himself.

In 1975, Manios launched his business career together with his brother, initially selling fuel to yachts in Athens’ marinas. He participated in the company Ship Oil and gradually built up a clientele including several expanding shipping companies of the 1970s and ‘80s.

Oil trading made Manios his first capital and an initial network of friends and contacts in the industry. At the beginning of 1977 he established Petroman, an outfit that specialised in trading bunkers and lubricants to various shipowners.

Among the key relationships that Manios established in the early 1980s was with Banque Internationale pour l’Afrique Occidentale (Biao Bank), a French bank that struggled with a number of troubled shipping loans at a time of one of the shipping industry’s harshest recessions.

They gained the bank’s confidence by assisting in providing solutions for a number of vessels mortgaged to the bank. In 1985, Manios – who was legendary for his public relations and likeability – persuaded the bank to lend them funds to acquire ships of their own.

In 1986, Transman Shipping Enterprises was born. Manios became a shipowner with impeccable timing as Transman was launched just before the end of the shipping crisis, when vessel values had dropped to historic lows.

The company’s first two acquisitions were Japanese-built handysize sister bulk carriers purchased from K-Line and named Saint Dimitrios and Saint Vassilios. Other vessels were derived from Biao Bank but were not always of the standard required and some needed heavy investment to bring them up to scratch. But the rapid growth of the fleet gave Manios the opportunity to sell off some the vessels at a critical moment as, post-crisis, prices being paid for ships tripled or quadrupled, offering spectacular profits.

Illustrative of his rapid rise, in 1989 the young tycoon paid more than $7 million to buy a world-renowned, 47-metre motor yacht, Parts VI, renaming it Madiblue D.

With brother Vassilios anchoring the office in Greece, Dimitris was travelling for up to 250 days annually, chasing a wide variety of business opportunities, deal-making, solidifying relationships with financiers, and cultivating friendships with an astonishing array of heads-of-state, politicians, royalty and international leaders in the worlds of industry and finance. Usually, the trips were facilitated by a new company jet and Manios often took one of his beloved dogs on board.

By 1990 more than half the fleet had been sold at a profit, mostly to Norwegian investment vehicles, generating estimated proceeds of about $200 million. Transman continued actively buying and selling vessels on the secondhand market, concentrating mainly on dry bulk carriers but also diversifying into general cargo, refrigerated vessels and containerships.

In addition to the dry cargo fleet operated by Transman, in 1991 a sister company Transoil was established for tankers. A fleet of suezmaxes and an ultra-large crude carrier was rapidly acquired in partnership with shipowner Lou Kollakis of Chartworld.

The partners also acquired the historic Pallion Shipyard in Sunderland from the UK government, aiming to restore the yard to activity at the end of a moratorium on shipbuilding imposed by the European Union. Unfortunately, the plans were stymied for many years after Brussels extended the duration of the ban and further delays were caused by local politics.

At the same time, Manios wanted to invest in Greece and his horizons extended well beyond the shipping market. Together with a partner, he appeared to have won a tender to acquire the beleaguered Neorion Shipyard in Syros, although the deal was eventually blocked. He also clubbed together with other Greek owners in a consortium to rescue Hellenic Shipyards, but this never came to fruition. He also looked at hotel projects in Greece and acquired marquee real estate in the US.

A year before his death, his group placed its first newbuilding orders – for two aframax tankers – at Hyundai, only to cancel this later on as Manios felt the design needed modification to embrace new oil industry safety requirements.

He was also planning a private equity placement that would set the group on the path to a possible public listing in future.

When he died in April 1995, Manios left a Transman and Transoil fleet with capacity of close to 2m dwt tons in bulk carriers and tankers.

The shipping business is carried on today by his brother Vassilios Manios and his sister Liza Manios-Zachariou.